Start Here

This blog demonstrates how airport operations leaders can reverse declining non-aeronautical revenue by implementing digital wayfinding technology as a revenue optimization platform rather than a cost center. It provides five data-backed strategies, from dynamic parking management to analytics-driven retail optimization, that transform passenger navigation anxiety into confident exploration, directly increasing dwell time and commercial spending across F&B, retail, advertising, and premium services.

Airport Ops and Customer Experience teams face a critical challenge in 2026: passengers are now digital natives, and they expect the same digital navigation experience at airports that they receive when shopping online or buying a movie ticket.

Airline app usage is up 7% in just five years, rising to 23% of passengers, according to the SITA 2025 Passenger Report.

— SITA Passenger Report

Yet airports are lagging behind the digital curve—only about 35% of airports have a digital strategy, and as of 2023, only about half of the world’s largest airports have an active mobile app.

While airlines pressure airports to reduce aeronautical fees and infrastructure demands continue climbing, many airport operations leaders still rely on static signage and outdated wayfinding approaches that do nothing to drive commercial revenue. Meanwhile, your passengers arrive already frustrated by the travel experience, unable to find what they need, and rushing past revenue opportunities.

This guide reveals how strategic airport wayfinding technology transforms both passenger experience and airport operations—unlocking proven revenue streams that leading airports are already capitalizing on. These data-backed strategies are designed to improve passenger experience, drive non-aeronautical revenue and streamline operations.

The state of airport revenue management

Airports today generate about 40% of their revenue from non-aeronautical sources. This performance gap translates to tens of millions in annual revenue – the difference between funding ambitious infrastructure projects and struggling to maintain aging facilities.

The post-pandemic landscape has fundamentally shifted passenger behavior and expectations. Travelers now expect seamless digital experiences throughout their journey, from parking reservation to gate navigation to retail discovery. Airports meeting these expectations see measurable impacts.

Meanwhile, airlines continue pressuring airports to reduce aeronautical fees even as infrastructure investment needs grow. This squeeze makes non-aeronautical revenue optimization not just attractive but essential for competitive airport operations.

What's at stake for airport operations leaders

Every passenger walking through your airport represents about $7 in profit today. But trends in non-aero revenue per person are declining – down 4.75% from 2015 to 2023. Multiply that across millions of annual passengers, and the opportunity gap becomes staggering.

Beyond revenue, passenger satisfaction directly correlates with digital amenities availability. Airports offering comprehensive digital experiences from parking to gate see an improvement in positive sentiment among passengers.

Source: Airport Dimensions

This digital experience opportunity influences airline partnership negotiations, retail tenant attraction, and regional economic development opportunities.

Boards and stakeholders increasingly expect airport operations leaders to demonstrate innovation and financial performance. The airports making strategic digital transformation investments today are building sustainable competitive advantages that compound over time through network effects and data accumulation.

How do airports make money? Understanding airport revenue streams

First, let’s distinguish between aeronautical and non-aeronautical revenue.

In short, aeronautical revenue is income generated from core aviation activities: landing fees charged per aircraft movement, aircraft parking fees for gate and apron usage, passenger facility charges collected per departing passenger, and terminal space rentals to airlines.

While obviously essential to airport operations, pricing is often regulated by government authorities or capped by competitive pressures from nearby airports, so this revenue source is primarily out of the influence and control of airport management.

Interestingly, the long-term trend shows aeronautical revenue declining as a percentage of total airport income, accounting for roughly 54% of total revenue today at the average commercial airport.

Rising operational costs plus pricing pressure make for an unsustainable combination that makes it critical for airport leaders to diversify their non-aeronautical revenue strategies.

The scalability of non-aeronautical revenue

Non-aeronautical revenue is all income generated from the commercial ecosystem surrounding air travel. This wide-ranging category opens possibilities for airports to exercise greater pricing control and innovation compared to regulated aeronautical fees.

The main categories that make up non-aero revenue, as ranked by typical revenue contribution, include:

- Retail concessions (speciality shops, duty-free outlets, news stores, etc.)

- Food and beverage (restaurants, quick-serve counters, coffee shops, grab-and-go markets, etc.)

- Parking operations (short- and long-term garages and lots, valet services, EV charging, etc.)

- Advertising & sponsorships (digital directory advertising, terminal branding, sponsored lounges, etc.)

- Car rental commissions (fees from rental car operators)

- Real estate leading (terminal space for services, cargo facilities, airline support, etc.)

- Lounge operations (airline lounges, day-use facilities)

- Premium services (fast-track security, personal shopping, etc.)

Non-aeronautical revenue represents airports' fastest-growing income stream. And when paired with the finding that dwell time has a significant impact on food and beverage revenues per passenger, there’s a powerful imperative for airports to streamline passenger experiences with digital tools that enable better discoverability and experience.

How airport wayfinding and operations software transforms non-aeronautical revenue growth

Modern airport wayfinding software goes beyond simple directional assistance. It represents an intelligent, data-driven platform for passenger guidance and commercial optimization that fundamentally changes how airports generate non-aeronautical revenue.

For the most advanced airport operations software, core capabilities include:

- Real-time navigation adapting to changing conditions like gate reassignments and security wait times

- Wait time transparency so passengers can make informed decisions about when to proceed through checkpoints

- Personalized recommendations suggesting relevant services based on passenger context

- Seamless integration with revenue-generating services from parking to dining to retail

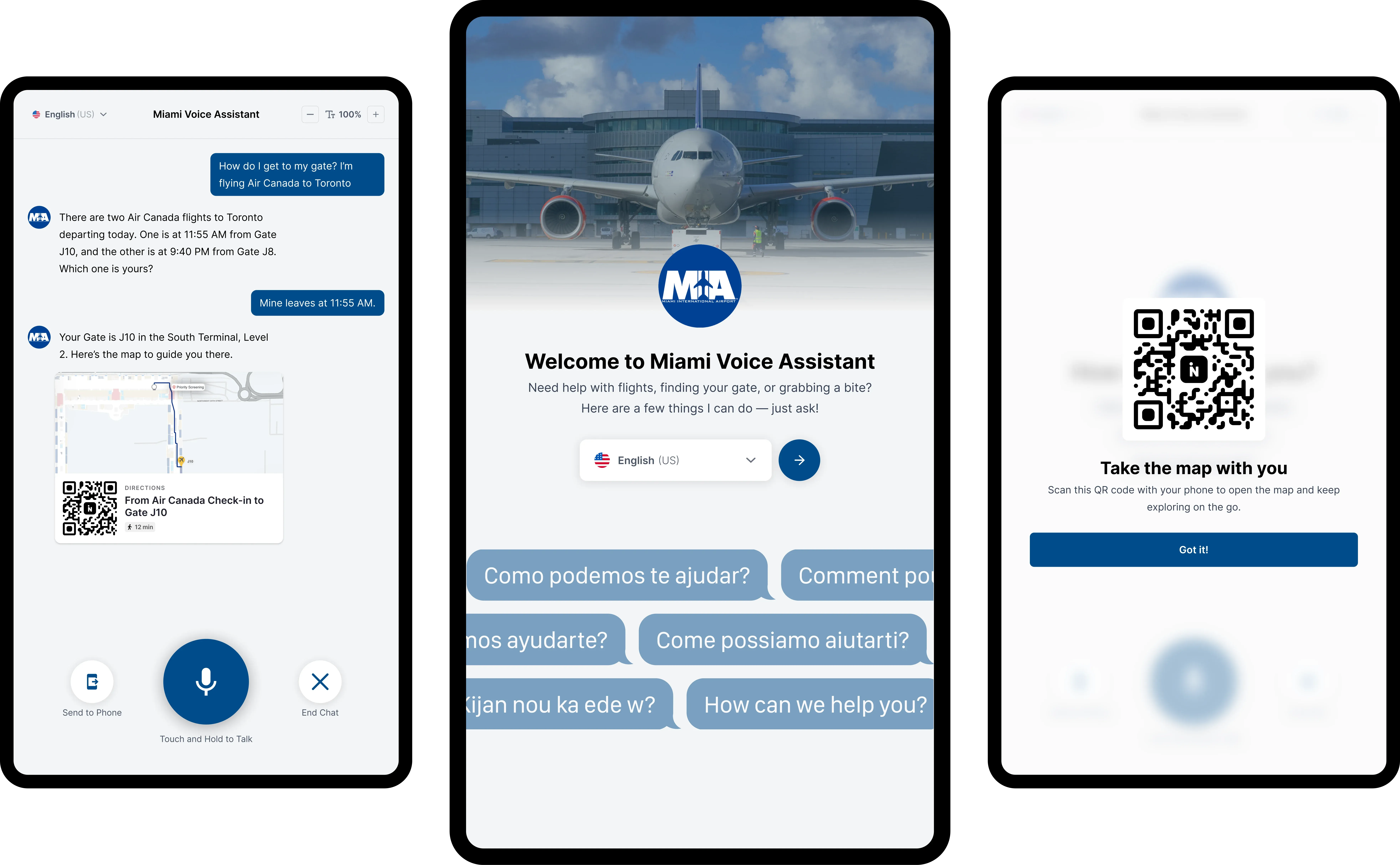

This technology ecosystem can connect seamlessly across channels—

- Mobile apps providing turn-by-turn navigation

- Digital directory kiosks positioned throughout terminals serving dual purpose as wayfinding tools and advertising platforms

- Responsive web integration allowing passengers to plan their journey before arriving

- Operational dashboards giving airport teams real-time visibility into passenger flows and system performance

What’s more, today’s passenger is ready for the digital-first experience, as a finding from SITA’s 2025 Passenger Report shows:

The business model shifts from viewing wayfinding as an operational cost center to recognizing it as a revenue optimization platform. Every passenger interaction generates valuable data while creating opportunities for commercial engagement.

4 ways digital airport wayfinding drives revenue

1. Increased passenger dwell time and discoverability

Travelers spend more than one third of their airport time on revenue-generating activities like dining, shopping and going online.

Digital wayfinding serves an essential purpose in driving passenger spend and exploration: when travelers trust they can reach their gate efficiently, they feel comfortable exploring retail and dining options rather than proceeding directly to departure areas.

The psychology is straightforward. Anxiety about finding gates, missing flights, or getting lost drives conservative behavior where passengers minimize exploration. Digital wayfinding with real-time updates and turn-by-turn guidance eliminates this anxiety, transforming stressed travelers into confident explorers.

2. Proximity marketing & targeted advertising

Digital directory kiosks deployed throughout terminals serve dual purposes that multiply their value. They provide essential wayfinding functionality while simultaneously operating as sophisticated advertising platforms generating substantial revenue.

Location-based promotions drive foot traffic to specific retailers by delivering contextually relevant messages. A passenger checking a directory screen near Gate B15 sees promotions for nearby dining options and shops along their route.

Source: Ipsos

The data advantage differentiates airports taking a digital approach to advertising from those stuck with static signage. Targeting by flight schedule, demographics, time of day, and specific location within the terminal lets advertisers to reach relevant audiences at optimal moments.

3. Pre-booking and services reservations

The parking headaches and long wait times are often the first thing that come to mind for flustered passengers who have been previously burned from poor experiences. And the data proves its importance to the holistic airport experience: 64% say shorter wait times at the airport is the most important factor in improving their travel.

Food and beverage pre-ordering reduces wait times while guaranteeing revenue for restaurant partners. Travelers order meals through the wayfinding app, receive notifications when food is ready, and navigate directly to pickup locations.

Lounge access upgrades convert at high rates when offered at strategic moments—specifically when passengers check wait times and see "Current security wait: 45 minutes - Relax in our lounge instead for $45" messages.

This in-venue moment captures passengers actively experiencing pain points rather than making them proactively seek staff assistance.

Premium service upsells including fast track security, porter services, and personal shopping assistance benefit from similar contextual promotion. The wayfinding platform identifies relevant moments (long security lines, passengers with mobility flags, luxury retail browsers) and delivers targeted upgrade offers.

4. Analytics-driven airport operations improvements

Knowing where your passengers are precisely when they experience navigation bottlenecks, confusion or seeking out food or drink options in the area can transform lease negotiations with retail tenants.

With real-time analytics, airports can demonstrate actual traffic patterns and dwell time data rather than relying on simple passenger counts or guesses. Premium locations with proven high-value traffic command higher minimum annual guarantees and percentage rents.

Identifying underperforming retail locations becomes data-driven instead of anecdotal. For example, a high-traffic location with low retail conversion suggests tenant mix problems or service quality issues that can be fixed through lease non-renewals or operational interventions.

Real-time analytics can also enable dynamic pricing for parking, lounges, and premium services. Airports adjust rates based on demand patterns, time until flight departure, and capacity availability.

5 proven strategies to increase non-aeronautical revenue

So, how can airport operators use these insights to solidify future-proof revenue strategies for years to come?

Below are five strategies that represent a comprehensive framework for tech-driven revenue optimization. Start with quick wins that build momentum, then progress to more sophisticated and long-term digital transformation initiatives.

— Yuval Kossovsky, Managing Director of Transportation, Mappedin

Success requires cross-departmental collaboration spanning IT, operations, marketing, retail partnerships, and finance. Data-driven decision making replaces intuition, and passenger-centric design ensures that revenue optimization enhances rather than compromises travel experience.

1. Deploy smart airport digital wayfinding

Comprehensive indoor mapping software can power seamless digital wayfinding accessible via mobile applications, mobile pass, responsive web platforms, and digital directory kiosks positioned strategically throughout terminals.

The system provides turn-by-turn navigation, real-time updates on gate changes and wait times, service discovery features, and integrated pre-booking capabilities. This seamless navigation allows for passengers to explore more and stress less, opening up opportunities for more spend on things like shopping and dining.

2. Implement dynamic parking revenue management

Passengers are making it clear: they want one digital tool or app to manage their entire experience. Implement a tool that offers real-time parking availability combined with advance reservation systems and that integrate seamlessly with wayfinding platforms.

Passengers check availability, compare options, book specific spaces, and receive navigation guidance directly to their reserved location—all within a single digital experience.

3. Create hyper-targeted advertising programs

Digital out-of-home advertising works. Run digital advertising programs that leverage passenger data and location context to deliver personalized, relevant messages at optimal moments throughout the passenger journey. For example, restaurant advertising that appears next to a dining zone with navigational guidance: “50 meters ahead on the right.”

This goes far beyond static signage to create a sophisticated advertising platform comparable to premium digital advertising networks.

4. Launch food and beverage mobile ordering & pickup

60% of travelers say ordering food from an airport app would improve their experience.

Roll out mobile ordering capabilities integrated seamlessly within the wayfinding software to allow passengers to browse menus, place orders, pay digitally, and navigate directly to pickup locations within a unified experience.

This strategy is a win-win: Passengers save significant time by skipping ordering lines and waiting periods, particularly valuable for travelers with tight connections or families with children. Restaurants guarantee sales before passengers even arrive, smooth demand across time periods, reduce wait times, and increase order sizes when customers browse menus without time pressure.

5. Optimize retail mix using passenger flow analytics

A longer-term but scalable strategy to boost revenue is using data to make smart decisions about tenant placement, lease negotiations, and retail category mix based on comprehensive passenger flow analytics. This approach separates the digital innovators from the status quo followers and takes retail management from reactive to strategic.

Portfolio optimization during lease renewals represents the highest-value application of flow analytics.

Rather than simply renewing existing tenants, airports can strategically curate a retail mix that maximizes revenue per square foot while improving passenger experience through better category balance and brand selection.

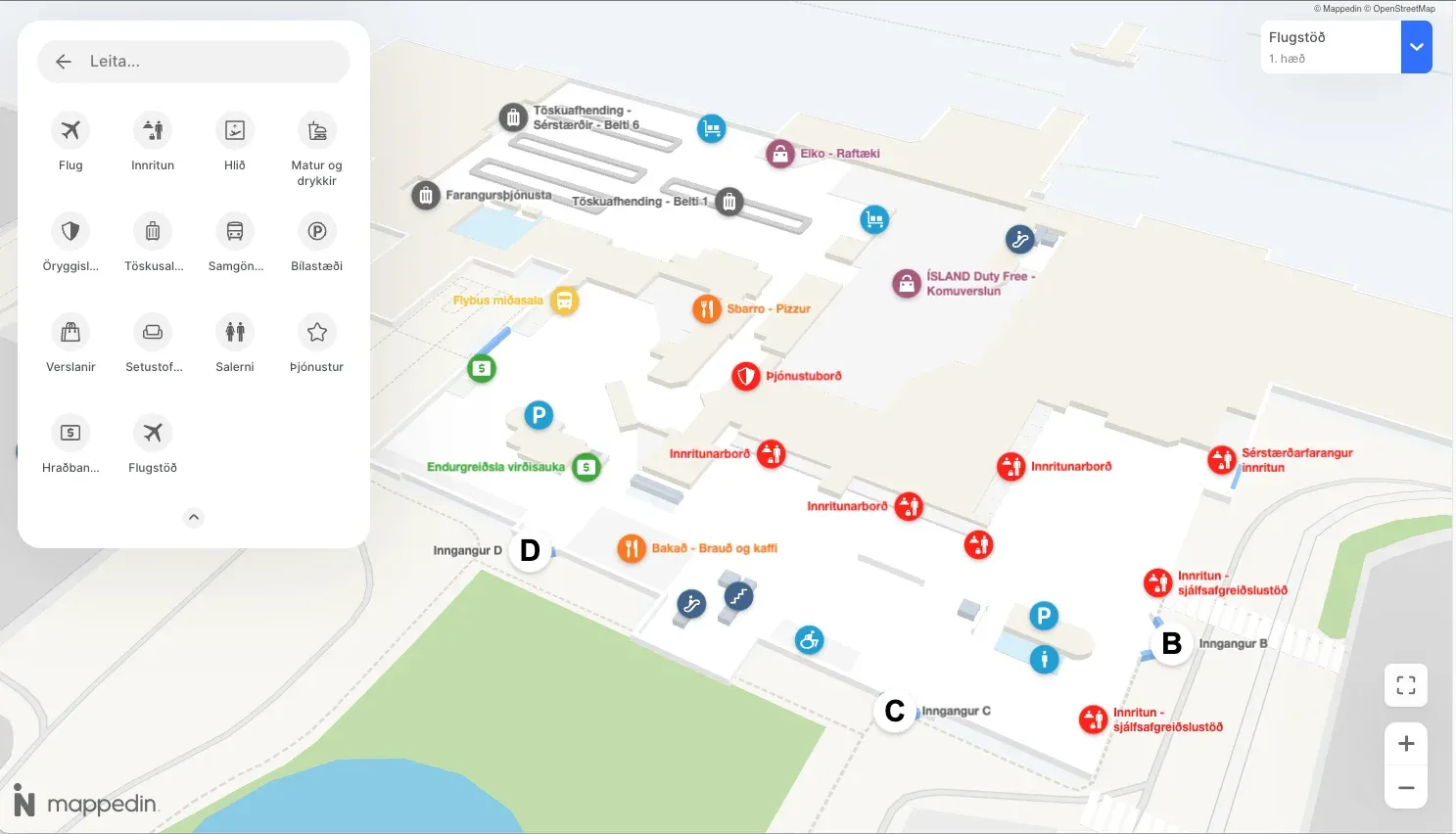

Success story: Keflavík Airport + Icelandair partner with Mappedin to deliver a connected, data-driven travel experience

By partnering together and rolling out their indoor mapping platform powered by Mappedin Keflavík Airport and Icelandair have built a unified experience that helps travelers navigate with confidence, streamlines behind-the-scenes operations, and unlocks new revenue opportunities.

Keflavík International Airport implemented Mappedin as a centralized source of truth—from parking to gate. Passengers can access real-time data including parking availability, security wait times, flight information, gate locations, amenities, accessibility routes, and live service information.

Through their partnership, Icelandair integrates the same mapping data into its passenger app, so travelers can enjoy a seamless digital experience with no information gaps.

— Guðný Halla Hauksdóttir, Director of Customer Experience, Icelandair

FAQs about airport revenue management and wayfinding

What percentage of airport revenue comes from non-aeronautical sources?

The global average sits at approximately 45%, but this varies significantly based on airport size, passenger demographics, and digital maturity. Airports with advanced digital wayfinding and revenue optimization platforms consistently perform in the upper range of this benchmark.

How does digital wayfinding increase airport retail revenue specifically?

Digital wayfinding increases retail revenue through four key mechanisms: passengers spend more time in commercial zones when they can navigate confidently, strategic routing drives more foot traffic to specific retailers, pre-booking integrations boost conversion rates, and real-time analytics enable data-driven retail mix optimization. Combined, these factors typically generate notable revenue lift across non-aeronautical revenue.

What is indoor mapping software and how does it work for airports?

Indoor mapping software like Mappedin combines digital wayfinding with analytics to optimize non-aeronautical revenue streams by tracking passenger flows, enabling service pre-booking, delivering targeted advertising, and providing predictive insights. The platform integrates with existing airport systems like parking, POS, flight information displays, and advertising networks to create a unified view of passenger journeys and commercial opportunities.

How do we measure success of airport operations digital transformation initiatives?

Key performance indicators span three categories: revenue outcomes (non-aeronautical revenue per passenger, concession growth, advertising revenue, pre-booking adoption), passenger experience (NPS improvements, satisfaction scores, navigation efficiency), and operational efficiency (reduced staff inquiries, retail partner satisfaction, data-driven decisions). Establish baselines pre-implementation, track metrics monthly, and benchmark against industry standards to isolate digital transformation impact from other variables.

Can digital wayfinding integrate with our existing airport systems?

Yes, modern platforms use API-first architecture designed to integrate with common airport systems including parking management, POS/retail platforms, flight information displays, advertising networks, and CRM tools through pre-built connectors.

Most airports successfully connect core systems within 8-12 weeks, with phased approaches reducing initial complexity by starting standalone and progressively expanding connectivity. Experienced vendors bring integration expertise from dozens of implementations, typically having worked with your specific systems before.

What differentiates Mappedin from other airport wayfinding solutions?

Mappedin is purpose-built for airport revenue optimization with proven track record at leading airports like LAX, Pittsburgh International Airport, and Melbourne Airport. It offers comprehensive analytics providing actionable business intelligence, seamless integration with other airport services, and award-winning developer documentation enabling rapid customization.

White-label flexibility matches airport branding while the ongoing partnership approach provides dedicated success teams, quarterly business reviews, and continuous optimization support.

Ready to transform your airport revenue?

Non-aeronautical revenue optimization is more essential than ever for competitive airports serving digital native passengers. The strategies outlined in this guide aren't theoretical possibilities but proven approaches delivering measurable results at airports worldwide.

Digital wayfinding technology serves as the foundation for modern airport revenue management, enabling capabilities that simultaneously enhance passenger experience and drive commercial performance.

Early adopters are already capturing these benefits and building sustainable competitive advantages. Passenger expectations continue rising as digital experiences become standard across retail, hospitality, and transportation sectors. Competitive pressure from peer airports implementing these strategies intensifies as laggards fall further behind on both passenger experience and financial performance.

Related resources

Share